Korean VAT for Foreign Digital Service Providers: Simplified Registration Explained

As the global economy becomes increasingly digital, international trade in goods and services has expanded rapidly. Today, it’s easier than ever for Korean consumers to buy apps, stream media, or subscribe to cloud services from foreign providers.

However, many of these foreign-supplied digital services historically did not include Korean Value Added Tax (VAT), creating an uneven playing field for domestic companies that had to charge VAT on similar services.

To ensure fair competition and proper taxation, the National Tax Service (NTS) of Korea introduced a simplified VAT registration and filing system for foreign businesses supplying electronic services to Korean customers.

1. Why This System Exists

The OECD’s International VAT Guidelines encouraged countries to address the risks of double taxation and non-taxation in cross-border e-commerce.

Following this, many countries — including Australia, New Zealand, the European Union, and Japan — revised their VAT or GST systems.

Korea joined this international movement by amending its VAT Act.

Since July 1, 2015, foreign suppliers of digital or electronic services to Korean consumers must register, file, and pay VAT in Korea through a simplified system.

2. Who Must Register

Under Article 53-2 of the Korean VAT Act, any of the following parties are required to register:

- Non-resident individuals or foreign corporations supplying digital services to consumers in Korea.

- Open-market platforms or intermediary agents through which foreign suppliers provide digital services to Korean users.

If your service is delivered through the internet or mobile networks and consumed in Korea, you’re generally required to comply.

3. What Counts as “Electronic Services”

Electronic services refer to products or content transmitted or accessed online through computers, mobile devices, or other communication networks. Examples include:

- Online games, e-books, music, videos, or software downloads.

- Cloud-computing and data-storage services.

- Digital advertising or brokerage services for renting, selling, or consuming goods and spaces in Korea.

In short, if your service can be downloaded, streamed, or accessed digitally, it’s likely covered.

Note: B2B transactions (services provided to registered Korean businesses) are non-taxable, as VAT is handled under reverse-charge or self-assessment rules.

4. How to Register for Simplified VAT

Foreign suppliers must complete a simplified business operator registration within 20 days from starting to supply services in Korea.

Step-by-step process:

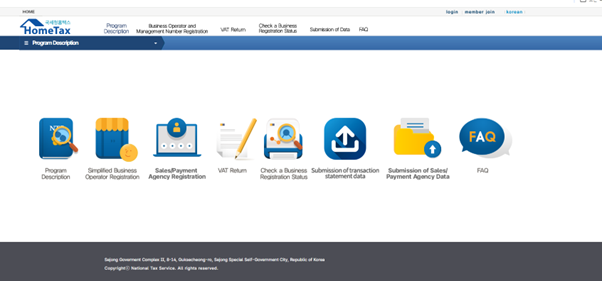

- Visit the NTS English website.

- On the bottom-left side of the homepage, click “Home Tax Service – Simplified Business Operator Registration & Filing Value Added Tax.”

- You will be redirected to the Hometax website (the online tax portal).

- On the Hometax page, click “Simplified Business Operator Registration.”

- Then select “Register.”

- Fill out the online registration form with your business name, type of service, country of incorporation, and contact details.

5. VAT Filing Schedule

VAT must be filed quarterly. The due date is always the 25th day of the month following the filing period.

| Filing Period | Due Date |

|---|---|

| Jan 1 – Mar 31 | Apr 25 |

| Apr 1 – Jun 30 | Jul 25 |

| Jul 1 – Sep 30 | Oct 25 |

| Oct 1 – Dec 31 | Jan 25 (next year) |

You can log in to the NTS system using your user ID, password, and VAT registration number to complete the electronic filing.

6. Paying the VAT

After filing, VAT must be paid by depositing funds into a foreign-exchange bank account designated by the NTS.

- The NTS (or your tax agent) will email your specific VAT account number.

- Payment must be made in Korean won (KRW), and you’ll need to cover any remittance fees.

- If payment is not received by the deadline, a tax payment notice will be issued.

📌Penalties for Late Payment

- 3 % of unpaid tax if not paid by the due date.

- 0.022 % additional penalty per day thereafter until full payment.

If you’re unsure about registration, filing, or payment procedures, feel free to contact our office for professional VAT assistance. We’re here to help you navigate Korea’s tax requirements.